Number of pages: 100 | Report Format: PDF | Published date: June 02, 2023

Historical Years – 2021 | Base Year – 2022 | Forecasted Years – 2023 to 2031

|

Report Attribute |

Details |

|

Market Size Value in 2022 |

US$ 20.97 billion |

|

Revenue Forecast in 2031 |

US$ 66.07 billion |

|

CAGR |

13.6% |

|

Base Year for Estimation |

2022 |

|

Forecast Period |

2023 to 2031 |

|

Historical Year |

2021 |

|

Segments Covered |

Type, Application, End User, and Region |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

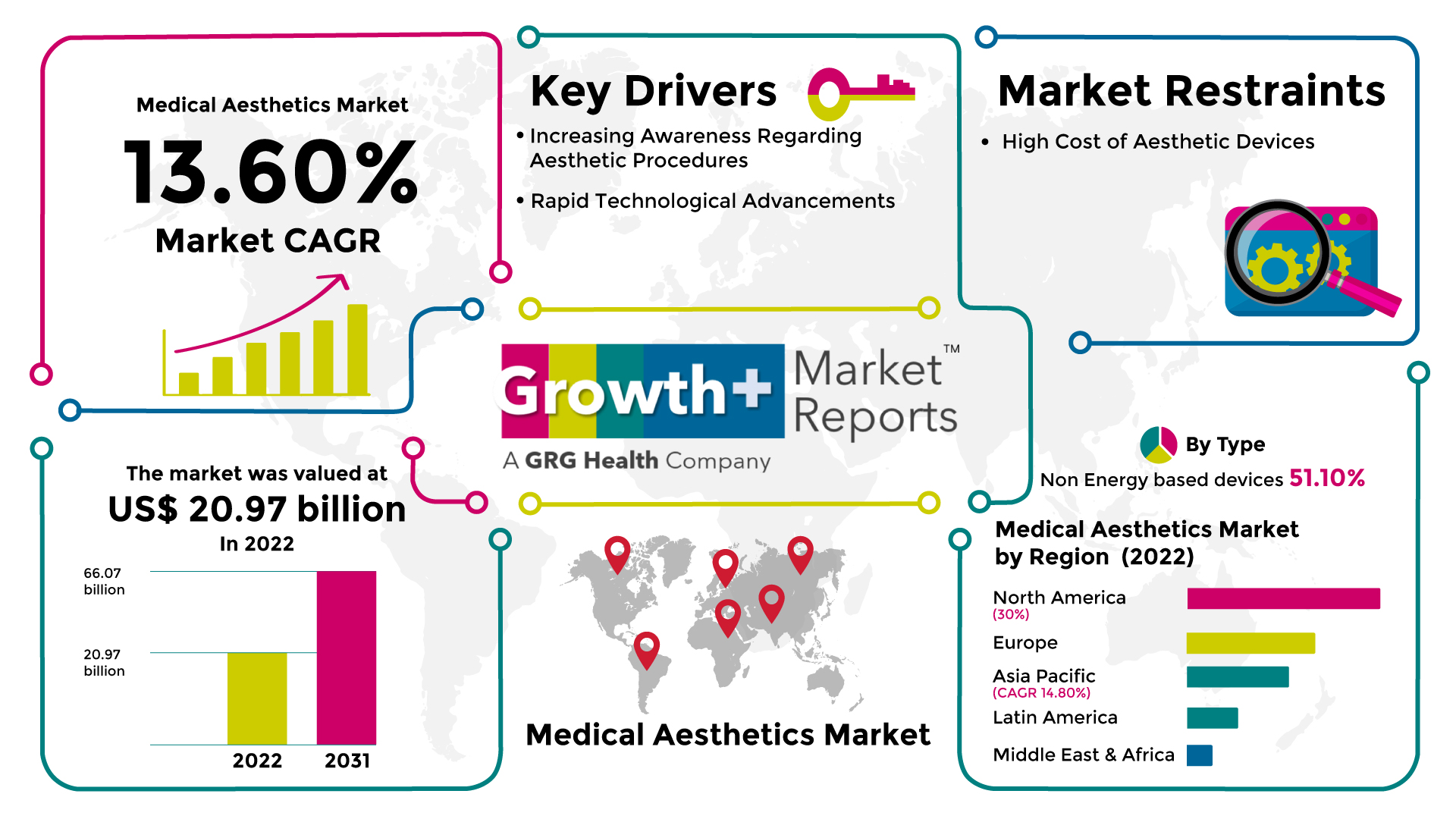

According to the deep-dive market assessment study by Growth Plus Reports, the global medical aesthetics market was valued at US$ 20.97 billion in 2022 and is expected to register a revenue CAGR of 13.6% to reach US$ 66.07 billion by 2031.

Medical Aesthetics Market Fundamentals

Medical aesthetics is largely concerned with enhancing and improving the feel, appearance, and body contours. This division treats scars, moles, liver spots, excess fat, wrinkles, loose skin, unwanted hair, cellulite, poker, and skin discoloration. Technology and equipment development has increased demand for the healthcare industry worldwide. The firm's main objective is to increase demand for the product by increasing consumer awareness of it. Different medical aesthetics technologies are being incorporated into healthcare systems in both developed and developing nations.

Medical aesthetics primarily consists of facial aesthetic products, body contouring tools, cosmetic implants, hair removal tools, skin lightening tools, tattoo removers, thread lift tools, physician-dispensed cosmeceuticals, skin lighteners, physician-dispensed eyelash tools, and laser nail treatment tools. Products and treatments that are intended to give people an attractive and young appearance are known as facial aesthetic products. These goods are offered for sale through retail and direct tender distribution channels. They are used for a variety of purposes, including cellulite reduction, tattoo removal, facial and skin rejuvenation, breast enhancement, anti-aging, and wrinkle reduction. Clinics, hospitals, medical spas, beauty salons, and home care facilities were among the different uses.

Medical Aesthetics Market Dynamics

There has been a steady rise in the number of cosmetic operations done globally in recent years. Due to the numerous advantages these treatments offer, most of the population chooses minimally invasive and non-invasive procedures like botulinum toxin and dermal fillers, which is the cause of the surge. Reduced side effects, quicker recovery, and painless operations are just a few of the advantages provided. According to statistics released by the Aesthetic Society in 2021, the total number of non-surgical treatments performed in the United States grew by 44.0% in 2021 compared to the previous year. Additionally, each year sees a rise in the acceptance and popularity of cosmetic operations among the male population. The demand for non-energy-based operations like botulinum toxin and dermal fillers is to blame for the overall increase in the number of procedures carried out. The total demand for medical aesthetics is a result of these factors and a better gender balance in the adoption of cosmetic operations.

The main trend gaining traction in the medical aesthetics industry is the use of robot-based surgery. Major players in the medical aesthetics industry are concentrating on creating innovative technology solutions to improve their position. For instance, in November 2021, UK-based manufacturing company Smith-Nephew introduced CORI, a surgical instrument that uses robotic technology. It is a cutting-edge portable robotic device used in full and partial arthroplasties of the knee. It is a portable, compact solution that combines a cutting-edge robotic sculpting tool with a 3-D intraoperative imaging system. It is the first technology to put the surgeon in the digital operating room. Patients have less discomfort during treatment and need fewer modifications as a result, which increases patient satisfaction after surgery.

Furthermore, the market is expanding faster because of a rise in medical tourism, increased disposable incomes, and growing awareness of aesthetic specializations. Another element boosting market expansion is a rise in consumer expenditure on cosmetic medications around the globe. The growth of the medical aesthetics sector is also anticipated to be fueled by increasing rates of breast cancer, trauma, and traffic accidents. For instance, the Medical Tourism Association (MTA) estimates that over 14 million individuals worldwide go abroad yearly for medical treatment. Global medical tourism has risen due to significant developments in the healthcare sector, including the introduction of new medical technologies and less invasive surgery techniques. In recent years, medical tourism has become more popular in high-income nations like the United States. A Mckinsey and Company survey states that 40% of individuals travel abroad for medical care due to the availability of cutting-edge technology and highly skilled specialists. This shift is partly a result of the fact that patients now expect prompt medical care without a long wait.

To match the growing demand for aesthetics throughout the world, different market participants are concentrating on releasing new products, which is raising the price of the devices on the market. For instance, according to information released in 2021 by Medicreations, the average price of new cosmetic gadgets can range from USD 120,000 to USD $300,000. Additionally, consumers are restricted from getting cosmetic treatments due to the high prices of surgeries like breast augmentation and abdominoplasty and the absence of reimbursement schemes to cover these procedures, as most people cannot afford such high expenses.

Medical Aesthetics Market Ecosystem

The global medical aesthetics market is analyzed from the following perspectives by type, application, end user, and region.

Medical Aesthetics Market by Type

Based on the type, the global medical aesthetics market is segmented into energy-based devices and non-energy-based devices.

The non-energy-based devices segment will likely dominate the market during the forecast period, with a market share of 51.1% in 2022; the non-energy-based treatments segment led the market and is anticipated to expand at the fastest CAGR during the projected period. The desire for non-invasive procedures has increased globally due to variables including less discomfort, fast outcomes, and low cost. Soft tissue fillers, chemical peels, and Botox injections are popular non-invasive treatments. For instance, the FDA approved JUVÉDERM® VOLUMATM XC for the enhancement of the chin area in people over the age of 21 in June 2020. Allergan Aesthetics is a division of AbbVie Inc. (U.S.). In addition, the FDA authorized the product Jeuveau in 2019; it is identical to Botox but costs less than Botox. In terms of minimizing wrinkles, the product is determined to be beneficial. Aesthetic surgeries requiring significant incisions include liposuction, breast augmentation, and nose contouring. These invasive treatments are more in demand now that physical beauty is receiving more attention.

Medical Aesthetics Market by Application

Based on the application, the global medical aesthetics market is segmented into body contouring, cellulite reduction, and hair and tattoo removal.

The market share leader in 2022 was the skin resurfacing & tightening segment. There is a sizable patient base receiving different treatments for skin disorders such as acne scars, fine lines and wrinkles, sagging skin, and others, which is driving up demand for treating such conditions. The demand from patients for technical breakthroughs in skin resurfacing operations is rising, and the industry is expanding due to government agency approvals for introducing cutting-edge technologies. The Renuvion Dermal Handpiece may now be used for particular dermal resurfacing operations, according to an announcement made by Apyx Medical in May 2022. The Renuvion Dermal Handpiece is intended for the treatment of rhytides and moderate to severe wrinkles.

Medical Aesthetics Market by End User

Based on the end user, the global medical aesthetics market is segmented into hospitals and specialty clinics.

In 2022, the specialty clinics segment gained the most market share. This market is expanding as a result of the surge in demand for minimally invasive treatments and the migration of patients from hospitals to specialized clinics. Aesthetic operations are being performed in a large number of specialty clinics throughout the world, which is helping the market grow. According to information provided by Policy Bee Ltd., 950 or more medical aesthetics clinics are operating in the United Kingdom as of 2022.

Hospitals, on the other hand, are predicted to see a sizable CAGR between 2023 and 2031. The expansion is mostly related to the rise in surgical operations, especially breast surgeries and other surgeries that are often carried out in hospitals.

Medical Aesthetics Market by Region

Based on the region, the global medical aesthetics market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

North America accounted for a large portion of the global revenue in 2022, with 30% share. Some of the key factors influencing the growth of the regional market include the region's advanced healthcare infrastructure, high acceptance of cosmetic operations, rising incidence of skin problems, and the availability of many qualified & competent cosmetic surgeons. The American Society of Plastic Surgeons (ASPS) analyzed the rise in cosmetic surgery operations from 2000 to 2018.

The region with the greatest expected CAGR throughout the projection period is Asia Pacific, at 14.8%. Countries like China, India, and South Korea support the area. The accessibility of high-tech goods and the increased emphasis on physical attractiveness both contribute to the development. The medical aesthetics sector in India is expanding quickly, particularly in the nation's major cities and throughout a number of states. The increasing use of aesthetic operations, new technology, and the need for procedures to enhance appearance are the main drivers of this business. The rush of competition, business, and investment from domestic businesses and foreign competitors looking for a sizable client base are some of the other considerations. For instance, the overall number of aesthetic treatments in 2020 was 524,064, comprising 255,528 surgical and 268,526 non-surgical procedures, according to the International Society of Aesthetic Plastic Surgery Report 2020. More aesthetic devices would be needed in India due to the rising number of aesthetic operations, which will fuel market expansion.

Additionally, with the country's rising obesity rate, there has recently been a spike in demand for this operation in India. According to the same research, India's urban obesity prevalence climbed from 4.9% in 2010 to 9.1% in 2020 and is projected to reach above 16% by 2040. After significant surgeries or weight reduction operations, body contouring procedures are performed to tighten the skin.

Medical Aesthetics Market Competitive Landscape

Some of the prominent market players in the global medical aesthetic market include,

Medical Aesthetics Market Strategic Developments

The field of medicine known as medical aesthetics is largely concerned with ways to enhance and improve the feel, appearance, and body contours. This division treats scars, moles, liver spots, excess fat, wrinkles, loose skin, unwanted hair, cellulite, poker, and skin discoloration.

The skin resurfacing & tightening segment led the global medical aesthetics market.

The estimated market size of the medical aesthetics Market in 2031 will be US$ 66.07 billion.

The revenue CAGR of the medical aesthetics market during the forecast period will be 13.6%.

Some of the prominent market players in the global medical aesthetic market include Allergan Plc, Johnson & Johnson, Galderma.

*Insights on financial performance are subject to the availability of information in the public domain