Number of pages: 100 | Report Format: PDF | Published date: May 24, 2023

Historical Years – 2021 | Base Year – 2022 | Forecasted Years – 2023-2031

|

Report Attribute |

Details |

|

Market Size Value in 2022 |

US$ 1.73 billion |

|

Revenue Forecast in 2031 |

US$ 2.73 billion |

|

CAGR |

5.2% |

|

Base Year for Estimation |

2022 |

|

Forecast Period |

2023 to 2031 |

|

Historical Year |

2021 |

|

Segments Covered |

Type, Application, End User, and Region |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

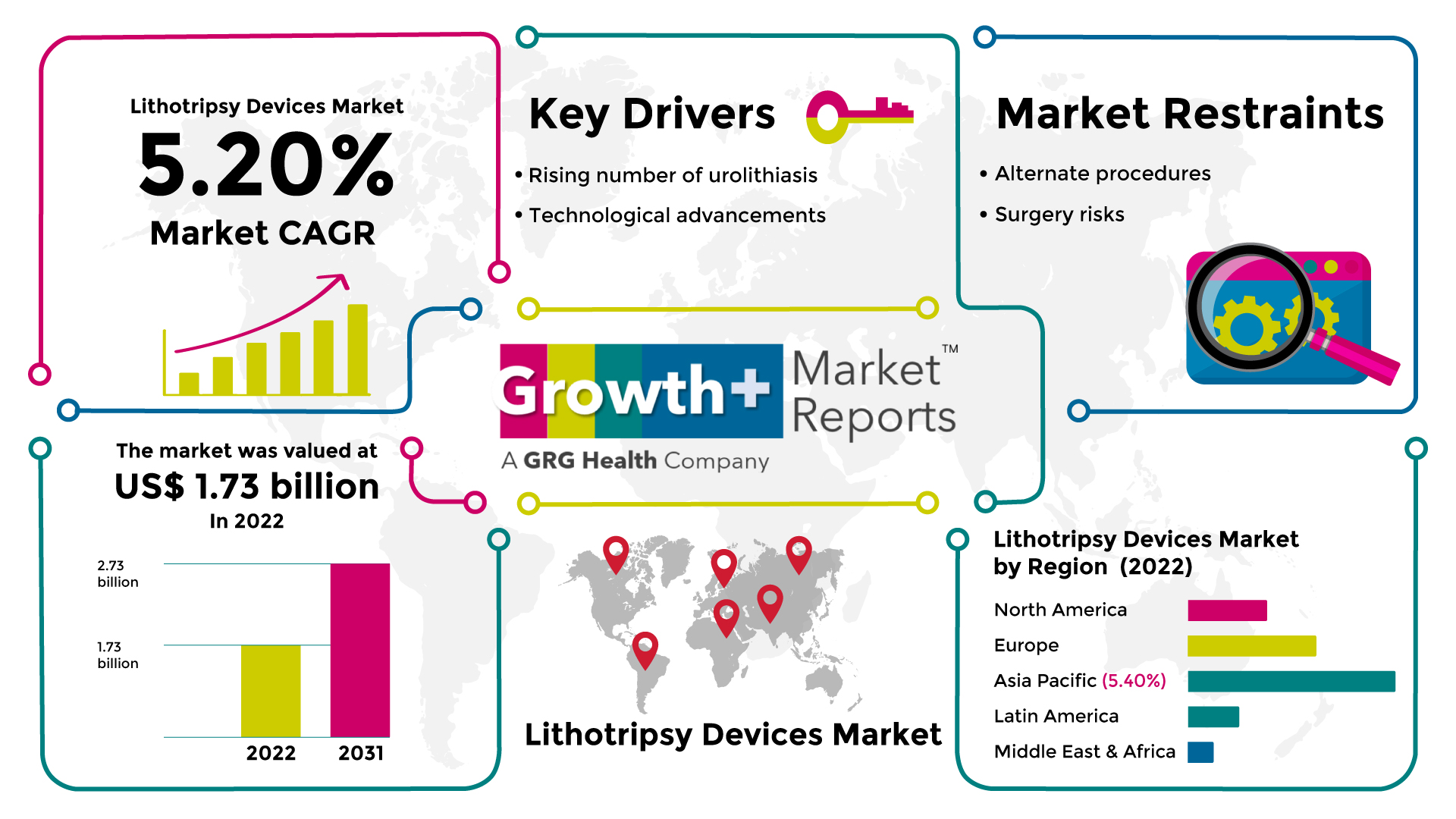

According to the deep-dive market assessment study by Growth Plus Reports, the global lithotripsy devices market was valued at US$ 1.73 billion in 2022 and is expected to register a revenue CAGR of 5.2% to reach US$ 2.73 billion by 2031.

Lithotripsy Devices Market Fundamentals

Lithotripsy is a medical procedure used to treat kidney stones. Large kidney stones are broken up into smaller ones using sound waves, and fluoroscopy makes it simple to see this process in action. By applying shock waves to the stone in the targeted location, ultrasonic waves break the stone into smaller bits that can flow through the urinary system. The x-ray focuses the kidney stone on these shock waves produced by lithotripter equipment. These waves enter the body through the skin and tissue, and when they finally get to the stone, they shatter it into tiny pieces. According to the National Renal Foundation, renal disease may affect 1 in 3 persons with diabetes and 1 in 5 adults with high blood pressure. According to a recent study by The George Washington University, Washington, D.C. will be the state with the highest prevalence of chronic renal disease in the US by 2022; around 1 in 3 American adults are at risk for kidney disease, and 26 million currently have it.

The global lithotripsy devices industry analysis report comprehensively analyzes the market, with the factors that either aid or impede the market growth, such as its drivers, restraints, and opportunities. The research provides insight into the companies that operate in the Lithotripsy Devices market and their efforts to position themselves as key players through expansion strategies and innovations. It also highlights recent developments that contribute to the Lithotripsy Devices market growth. The research also analyzes the impact of the COVID-19 pandemic.

This research is valuable for businesses seeking insights into the market, customers, and competition. The research provides special insights into the segmentation, regions, market size & projection, revenue CAGRs, and other important information that may help clients make the right decisions. The report assembles data from market players and professionals across the industrial value chain. The study also incorporates qualitative and quantitative assessments from industry professionals. Secondary research, surveys and interviews, and statistical modeling are all used in our research to estimate market size and projection. Our reports deliver the most reliable market data because of our specialized research methods.

Lithotripsy Devices Market Dynamics

The main factors driving the market are a growth in urolithiasis prevalence, an increase in extracorporeal shock wave lithotripsy treatments, and technological improvements. The main factors influencing the demand for lithotripsy devices include the rising prevalence of urolithiasis, a prevalent urologic condition, and a large global burden on the healthcare system with a risk of end-stage renal failure. According to a European Association of Urology report, urinary stone prevalence rates range from 1% to 20%. Renal stone prevalence is greater than 10% in nations with high living standards, such as Canada, Sweden, or the United States. Over the past 20 years, certain regions have seen a growth of more than 37%. The important factor propelling the market for lithotripsy devices is the increase in the elderly population around the world. According to the National Institutes of Health (NIH), 6.17 million individuals, or 8.5% of the world's population, are 65 or older. This percentage is predicted to rise to 17% in 2050, resulting in approximately 1.6 billion people reaching this age.

Additionally, the UN Population Fund and HelpAge India research indicates that by 2026, there will be 173 million people over 60 in India. The market's overall growth is supported by factors such as rising government support for diagnostic testing such as X-rays and urine microscopy tests and factors like increasing investments in the creation of cutting-edge technology. In nine out of 23 stones, complete disintegration with a diameter of less than 2 mm occurred within 10 minutes of the burst wave lithotripsy treatment, according to a recent report from the University of Washington School of Medicine in Seattle.

However, the lithotripsy procedure carries several risks, such as internal bleeding occasionally resulting from it, necessitating a blood transfusion. As a result of the obstruction in the urine flow tube caused by microscopic stone particles linked to difficulties like high blood pressure can also have adverse effects, including kidney damage.

Lithotripsy Devices Market Ecosystem

Lithotripsy Devices Market, by Type

Lithotripsy Devices Market, by Application

Lithotripsy Devices Market, by End User

Lithotripsy Devices Market by Type

The extracorporeal shock wave lithotripsy (ESWL) devices segment accounts for the largest revenue share in the global lithotripsy devices market. Extracorporeal shock wave lithotripsy is a technique for treating stones in the kidney and ureter that do not require surgery. Extracorporeal shock wave lithotripsy is a non-surgical method for treating kidney and ureter stones. Instead, the body is subjected to extremely powerful shock waves that are used to smash rocks into sand-sized fragments. ESWL devices, also known as extracorporeal shock wave lithotripsy devices, are used to treat kidney and ureter stones. This technology's benefits, such as minimum invasiveness, reduced discomfort, shorter hospital stays, and speedier recovery time, are likely to expand its penetration over the next years. This technology has already been used by doctors all over the world. The remarkable efficacy of ESWL for treating urinary calculi was noted in a study published in the journal Disease Markers in July 2022. The study also highlighted the procedure's safety and lower incidence of adverse effects. The least invasiveness of the ESWL treatment and its widespread use is further highlighted by a study that was published in the Urolithiasis in January 2023. The significant advancements in the extracorporeal shock wave lithotripsy market are also anticipated to accelerate the segment's expansion. For instance, in September 2022, Advanced MedTech Holdings purchased the Chinese manufacturer of urology and shock wave therapy device, WIKKON. With the addition of the cutting-edge WIKKON portfolio of urological products, the acquisition would enhance Advanced MedTech Holdings' extracorporeal shock wave lithotripsy offering.

The market segmentation sections provide the lithotripsy devices market outlook in terms of the demarcation of different consumer groups. Market segmentation is the split of industry into subgroups depending on characteristics such as type, application, end user, and region. Market segmentation data helps organizations understand the preferences and distinctive demands of different customer groups and implement targeted marketing strategies. This data additionally helps in identifying potential Lithotripsy Devices market demand opportunities.

Lithotripsy Devices Market by Region

North America accounts for the largest global lithotripsy devices market revenue share. US kidney disease data illustrates the burden of end-stage renal disease (ESRD) and chronic kidney disease (CKD). The Centers for Disease Control and Prevention anticipated that 15% of adults, or around 37 million individuals, will have chronic renal disease in July 2022, which equates to one in seven persons. Over 50,000 lithotripsy treatments are performed annually in the United States due to the rise in kidney disease cases, which supports the growth of the lithotripsy devices market. Additionally, investments and innovations in the area are anticipated to accelerate the expansion of the North American lithotripsy market. For instance, an American medical device business specializing in renal care and kidney stone management obtained USD 32.7 million in funding in July 2022 as part of a Series C financing round that was co-led by Questa Capital and CR Group L.P. (CRG).

Based on the regions, the global lithotripsy devices market is segmented into:

The industry's regional segmentation provides insights into geographic pockets in terms of lithotripsy devices industry trends, market size, share, and growth rate. This information helps organizations assess potential growth opportunities in new regional markets, understand competitive threats, and develop localized sales and expansion strategies. This section also offers deeper insights into the regional and country-level lithotripsy devices market overview.

Key Components of the Report

Lithotripsy Devices Market Competitive Landscape

The market competitive landscape analysis is performed by gathering and evaluating data about the key competitors, industry trends, and market dynamics. It involves collecting and analyzing data on factors such as products, pricing, geographic reach, customer demographics, marketing tactics, and recent developments. Competitive landscape analysis can help organizations identify present or prospective opportunities and risks in the market.

Lithotripsy Devices Market Strategic Developments

Reasons To Buy This Report

Key Strengths of Our Report

Target Audience to Benefit from this Report

Lithotripsy devices are medical instruments or machines specifically designed to perform lithotripsy, which is a procedure used to break down kidney stones or other types of stones in the urinary tract. These devices use different methods to generate energy or waves that can fragment the stones.

Global lithotripsy devices are expected to grow at a revenue CAGR of 5.2% during the forecast period from 2023 to 2031.

Lithotripsy devices can be expensive to acquire and maintain. This cost factor can be a barrier, particularly for healthcare facilities with limited financial resources.

The total lithotripsy devices market was valued at US$ 1.73 billion globally in 2022.

The resultant market size of the global lithotripsy devices would be US$ 2.73 billion in 2031.

The rising number of urolithiasis and technological advancements in surgical procedures drive the global lithotripsy devices market.

Boston Scientific Corporation, Olympus Corporation, Cook Medical LLC, EDAP TMS S.A., and DirexGroup are the key players in the global lithotripsy devices market.

The extracorporeal shock wave lithotripsy devices segment accounts for the largest revenue share in the global lithotripsy devices market.

North America will have the largest lithotripsy devices market size during the forecast period from 2023 to 2031.

*Insights on financial performance are subject to the availability of information in the public domain