Number of pages: 100 | Report Format: PDF | Published date: May 29, 2023

Historical Years – 2021 | Base Year – 2022 | Forecasted Years – 2023 to 2031

|

Report Attribute |

Details |

|

CAGR |

6.7% |

|

Base Year for Estimation |

2022 |

|

Forecast Period |

2023 to 2031 |

|

Historical Year |

2021 |

|

Segments Covered |

Product Type, Modality, Material, and Region |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

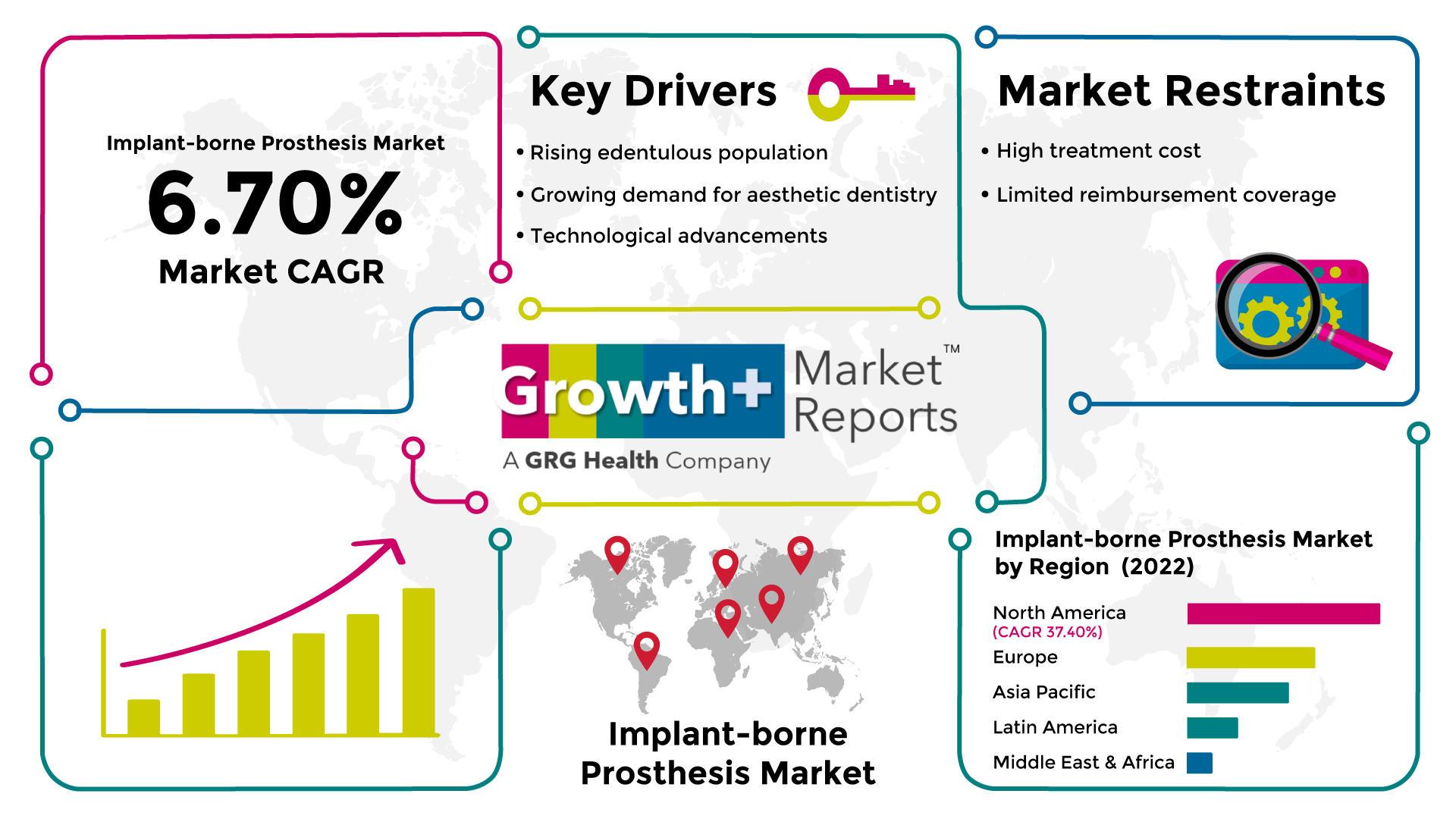

According to the deep-dive market assessment study by Growth Plus Reports, the global implant-borne prosthesis market is expected to grow at a revenue CAGR of 6.7% from 2023 to 2031.

Implant-borne Prosthesis Market Fundamentals

An implant-borne prosthesis is a dental prosthesis supported and anchored by dental implants. Dental implants are artificial tooth roots made of biocompatible materials, such as titanium or ceramic, surgically placed into the jawbone. The prosthesis, which could be a single crown, a bridge, or a denture, is then securely attached to the implants, providing stability and functionality similar to natural teeth. Unlike traditional removable prostheses, such as dentures, implant-borne prostheses do not rely on adhesives or clasps for support. Instead, they are fixed in place and feel more like natural teeth. The dental implants integrate with the surrounding bone through osseointegration, creating a strong and durable foundation for the prosthesis.

Implant-Borne Prosthesis Market Dynamics

The increasing number of people with missing teeth or complete tooth loss, known as edentulism, is a significant driver for the implant-borne prosthesis market. Dental implants provide an effective solution for restoring oral function and aesthetics in these individuals. According to the WHO, the estimated global prevalence of full tooth loss in individuals 20 or older is close to 7%. A substantially greater global frequency of 23% has been predicted for adults 60 years or older. There is a growing emphasis on dental aesthetics and the desire for natural-looking teeth. Implant-borne prostheses offer improved aesthetic outcomes compared to traditional removable dentures, making them a preferred choice for patients seeking enhanced dental aesthetics. There is a rise in the number of dental trauma cases, increasing the demand for implant-borne prostheses. According to the WHO, around 1 billion people are affected by dental trauma, with a prevalence of about 20% for children up to 12 years old. The implant-borne prosthesis market outlook is positive, with the rise in the advancements in dental implant technologies and materials that have significantly improved implant-borne prostheses’ success rates and long-term outcomes. Developing computer-aided design/computer-aided manufacturing (CAD/CAM) technologies and guided implant surgery has made the treatment process more precise, efficient, and predictable. With greater access to information and patient education, people are becoming more aware of the benefits of implant-borne prostheses. Patients seek dental treatments that provide long-term solutions and improved quality of life, leading to increased demand for implant-supported restorations. The rise in dental tourism has contributed to implant-borne prosthesis market demand. Dental implant procedures, including the placement of implant-supported prostheses, are often more affordable in certain countries, attracting patients from around the world.

However, implant-borne prostheses are generally more expensive than traditional removable dentures or bridges. The cost includes not only the implant surgery but also the fabrication and customization of the prosthesis. This higher cost can be a deterrent for some patients, which restricts the implant-borne prosthesis market growth. In certain healthcare systems, reimbursement coverage for implant-borne prostheses is limited or nonexistent. This can create financial barriers for patients, making the treatment less accessible and affordable and hindering the implant-borne prosthesis market growth.

Implant-borne Prosthesis Market Ecosystem

The global implant-borne prosthesis market is analyzed from four perspectives: product type, modality, material, and region.

Implant-borne Prosthesis Market by Product Type

Based on the product types, the global implant-borne prosthesis market is segmented into tissue- and bone-level prosthetics.

The tissue-level prosthetics segment accounted for the largest revenue share of the implant-borne prosthesis market 2022. Tissue-level prosthetics have been widely used in implant dentistry for many years and have demonstrated a high success rate. Dental professionals are often familiar with the techniques and procedures associated with tissue-level implant systems, which increases their comfort and confidence in using them. Tissue-level prosthetics offer the advantage of creating a realistic emergence profile, ensuring that the implant crown or prosthesis emerges from the gum tissue in a manner that closely mimics a natural tooth. This feature is crucial in achieving superior aesthetic outcomes, addressing a significant concern for many patients seeking implant-borne prostheses. Tissue-level prosthetics provide a space between the implant platform and the soft tissues, allowing for the formation of a healthy gum seal around the implant. This helps to prevent bacterial invasion and promotes gum health.

Additionally, the design of tissue-level implants facilitates easier access for oral hygiene maintenance, which is crucial for the long-term success of the prosthesis. Tissue-level implant systems are generally considered less complex regarding surgical placement than bone-level systems. The positioning of the implant platform at or slightly above the level of the soft tissues allows for easier accessibility and visibility during surgery, making the procedure more straightforward for many clinicians.

The bone-level prosthetics segment accounted for a considerable implant-borne prosthesis market share. Bone-level prosthetics are designed to be closer to the bone, allowing for improved stability and load distribution. This can be advantageous in cases where there are anatomical or clinical considerations that require a stronger and more stable implant connection. Advancements in implant technologies and materials have also played a role in the growth of the bone-level prosthetics segment. Improved designs, materials, and surface treatments have made bone-level prosthetics more appealing to dental professionals and patients alike, leading to increased adoption and market share.

Implant-borne Prosthesis Market by Modality

The global implant-borne prosthesis market is segmented based on the modalities into screw-retained and cement-retained.

The Screw-retained segment accounted for the highest revenue share of the implant-borne prosthesis market. Screw-retained prostheses offer the advantage of being retrievable and repairable. The use of screws allows for easy removal of the prosthesis, facilitating maintenance, repair, or replacement if necessary. Dental professionals highly value this retrievability feature as it provides flexibility in case of any complications or changes required in the prosthesis. Screw-retained prostheses often have an open access channel that effectively cleans and maintains oral hygiene. Patients can easily access and clean the area around the implant, which is crucial for long-term success and peri-implant health. Screw-retained prostheses offer greater flexibility in terms of prosthetic design and materials. They can accommodate a wide range of restorative materials, such as acrylic, porcelain, or zirconia, providing versatility in esthetic options. This flexibility enables dental professionals to customize the prosthesis to meet each patient's specific needs and preferences. Screw-retained prostheses are known for their superior stability and retention. Using screws ensures a secure connection between the implant and the prosthesis, minimizing the risk of prosthesis movement or dislodgment. Screw-retained prostheses have been widely used in implant dentistry for many years, and established clinical protocols and techniques are available for their placement and restoration. Dental professionals are often familiar with the procedures and protocols associated with screw-retained prostheses, which is also fueling segmental growth.

Implant-borne Prosthesis Market by Material

Based on the materials, the global implant-borne prosthesis market is segmented into zirconium, titanium, and others.

The titanium segment accounted for the prominent implant-borne prosthesis market share in 2022. Titanium has excellent biocompatibility, meaning it is well-tolerated by the human body. It forms a strong bond with the surrounding bone through a process called osseointegration, which promotes the long-term stability and success of the implant. The biocompatibility of titanium makes it a preferred choice for dental implant materials. Titanium is known for its exceptional strength and durability, making it suitable for withstanding the forces exerted during chewing and biting. Titanium implants have high fracture resistance and can withstand long-term use without significant wear or degradation. Titanium has been widely used in dental implantology for several decades. It has a proven track record of success and clinical efficacy. Dental professionals are well-trained and experienced in working with titanium implants, enhancing their confidence and preference for this material. Titanium implants are readily available and cost-effective compared to alternative materials. The wide availability and affordability of titanium implants make them accessible to more patients and dental professionals, increasing their dominance in the market.

Implant-borne Prosthesis Market by Region

Geographically, the global implant-borne prosthesis market has been segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The North America region has the largest implant-borne prosthesis market size in terms of revenue generation accounting for around 37.4% share of the market. North America has a significant prevalence of dental conditions, such as edentulism. The growing aging population and lifestyle factors contribute to the demand for implant-borne prostheses as a reliable and long-term solution for replacing missing teeth. According to the American College of Prosthodontists, More than 36 million Americans are toothless, and 120 million Americans are missing at least one tooth. The ratio of edentulous persons in the geriatric population is 2 to 1. Approximately 23 million people are totally edentulous, while another 12 million are edentulous in only one arch. Over the next 15 years, the number of partially edentulous patients will rise to more than 200 million. North America is at the forefront of dental implant technology and innovation. Advancements in materials, implant design, and manufacturing processes have improved the success rates, aesthetics, and durability of implant-borne prostheses. Patients in North America are increasingly aware of the benefits of implant-borne prostheses, including improved oral function, aesthetics, and overall quality of life. There is a growing demand for dental solutions that offer a natural look and feel, which drives the adoption of implant-borne prostheses. North America has a robust dental infrastructure that includes many well-trained dental professionals, specialized clinics, and advanced dental laboratories.

Implant-borne Prosthesis Market Competitive Landscape

The prominent players operating in the global implant-borne prosthesis market are:

Implant-borne Prosthesis Market Strategic Developments

An implant-borne prosthesis is a dental prosthesis supported and anchored by dental implants. Dental implants are artificial tooth roots made of biocompatible materials, such as titanium or ceramic, that are surgically placed into the jawbone.

Asia Pacific can be considered the key growth region due to the surge in implant-borne prosthesis industry trends in China, Japan, and the Indian subcontinent.

The major players operating in the global implant-borne prosthesis market are Dentsply Sirona Inc., Straumann AG, Zimmer Biomet, 3M Company, and Danaher Corporation.

The global implant-borne prosthesis market growth is estimated to grow at a revenue CAGR of 6.7% during the forecast period from 2023 to 2031.

The tissue-level prosthetics segment dominated the implant-borne prosthesis market.

*Insights on financial performance are subject to the availability of information in the public domain