Number of pages: 100 | Report Format: PDF | Published date: May 24, 2023

Historical Years – 2021 | Base Year – 2022 | Forecasted Years – 2023 to 2031

|

Report Attribute |

Details |

|

CAGR |

6.7% |

|

Base Year For Estimation |

2022 |

|

Forecast Period |

2023 to 2031 |

|

Historical Year |

2021 |

|

Segments Covered |

Type, Material, and Region |

|

Regional Scope |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

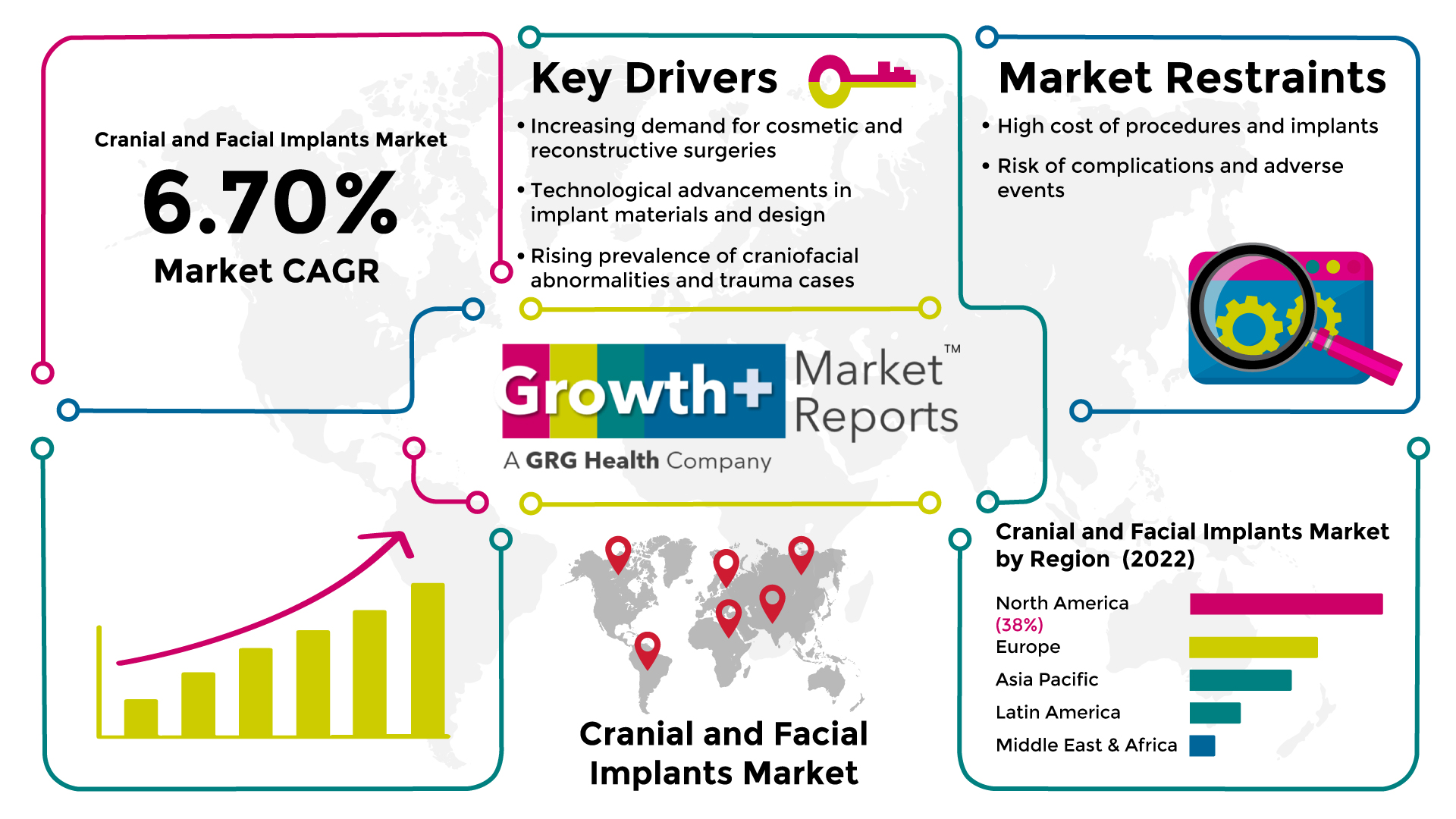

According to the deep-dive market assessment study by Growth Plus Reports, the global cranial and facial implants market is expected to grow at a revenue CAGR of 6.7% from 2023 to 2031.

Cranial and Facial Implants Market Fundamentals

Cranial and facial implants are medical devices designed to enhance or reconstruct the structures of the skull and face. They are typically made from biocompatible materials and are surgically implanted to improve the appearance, function, or support of the cranial and facial features. Cranial implants are used to repair or replace parts of the skull that have been damaged due to trauma, disease, or surgical procedures. These implants can help restore the natural contour of the skull, reinforce weakened areas, or correct skull deformities. Facial implants, on the other hand, are used to augment or enhance specific facial features. They are commonly employed to improve the shape and definition of the chin, cheeks, jawline, or other facial areas that may lack volume or symmetry. Facial implants can provide a more balanced and harmonious appearance to the face. These implants are individually tailored to each patient's needs and can be customized in terms of size, shape, and material. They are generally made from materials such as silicone, porous polyethylene, or titanium, which are well-tolerated by the body and can integrate with the surrounding tissues over time.

The research study on the cranial and facial implants market overview thoroughly analyzes the market and the aspects that either help or hinder the market's growth, such as its drivers, challenges, and opportunities. The research also discusses the list of businesses that operate in this market and their efforts to establish themselves as major players through expansion plans and innovative ideas. It also emphasizes current events that support the market's revenue expansion. The research also analyses how the COVID-19 pandemic has affected society.

This report is an important tool for the industry stakeholders to gather all the information about the market, customers, and competition. The report also provides the readers with valuable insights on the segmentation, regions, market size & forecast, revenue CAGRs, and other valuable data to help make informed strategic decisions. The study compiles information gathered from industry participants and specialists across the industry value chain. The report also taps into the qualitative and quantitative assessments by industry analysts. Our reports use different methods for estimating the market size and forecast, including secondary research, surveys and interviews, and statistical modeling. With these steps, our reports provide the most accurate market data. These datasets will cumulatively provide in-depth cranial and facial implants market forecast to the industry stakeholders.

Cranial and Facial Implants Market Dynamics

There has been a growing demand for cosmetic procedures to enhance facial features and improve overall appearance. Additionally, reconstructive surgeries are performed to correct craniofacial abnormalities caused by congenital defects, trauma, or disease. This increasing demand for aesthetic and reconstructive procedures has contributed to the growth of the cranial and facial implants market. According to the International Society of Aesthetic Plastic Surgery (ISAPS) annual Global Survey on Aesthetic/Cosmetic Procedures report, there is a 19.3% overall increase in procedures performed by plastic surgeons in 2021, with more than 12.8 million surgical and 17.5 million non-surgical, procedures performed worldwide. Materials science and implant design advancements have led to the development of more sophisticated cranial and facial implants. Newer materials offer improved biocompatibility, durability, and integration with the surrounding tissues.

Additionally, advanced imaging techniques, such as 3D printing and computer-aided design (CAD), have facilitated the production of patient-specific implants, resulting in better outcomes and increased demand. The global population is aging, and changes in facial structure and volume loss come with aging. This has led to an increased demand for facial implants to restore facial contours, enhance features, and reverse signs of aging. According to the WHO, the number of people aged 60 years and older is expected to double from 900 million in 2015 to 2 billion by 2050. Craniofacial abnormalities, such as craniosynostosis, cleft lip and palate, and facial asymmetry, affect many individuals worldwide.

Additionally, traumatic injuries, such as fractures or severe facial trauma, often require reconstructive procedures involving cranial and facial implants. According to the National Center for Biotechnology Information, the prevalence of craniosynostosis is 1 per 2000 to 1 per 2500 live births. Advancements in healthcare infrastructure, surgical techniques, and accessibility to specialized medical facilities have made cranial and facial implant procedures more widely available. This has increased the number of patients seeking cranial and facial implant surgeries, thus driving the cranial and facial implants market growth.

However, cranial and facial implant procedures are expensive, including the surgical procedure and the cost of the implants themselves, which restricts the growth of the cranial and facial implants market. Cranial and facial implant surgeries carry a risk of complications and adverse events. These can include infection, implant rejection, implant migration, tissue damage, or nerve injury, thus hindering the cranial and facial implants market growth.

Cranial and Facial Implants Market Ecosystem

Cranial and Facial Implants Market, by Type

Cranial and Facial Implants Market, by Material

Cranial and Facial Implants Market by Material

The porous polyethylene segment accounted for the largest revenue share of the cranial and facial implants market in 2022. Porous polyethylene has excellent biocompatibility, meaning it is well-tolerated by the body without causing adverse reactions. It is considered inert and does not elicit a significant immune response. This biocompatibility makes porous polyethylene a preferred choice for cranial and facial implants as it reduces the risk of complications or implant rejection. Porous polyethylene implants are highly versatile and can be easily shaped and customized to match the patient's specific needs. The material is malleable, allowing surgeons to contour and adjust the implant during the surgical procedure to achieve optimal fit and aesthetic outcomes. Porous polyethylene is radiolucent, meaning it does not interfere with diagnostic imaging techniques such as X-rays, CT scans, or MRI scans. This radiolucency allows for accurate postoperative evaluation and monitoring without obstruction from the implant. It simplifies the follow-up process and contributes to the market preference for porous polyethylene implants. Porous polyethylene implants offer excellent stability and durability. The material's porous structure allows for the ingrowth of the patient's bone and soft tissue, promoting integration and long-term stability of the implant.

Segmentation of the market refers to the division of the industry into subgroups based on factors such as type, material, and region. Market segmentation data helps businesses to understand the preferences and unique needs of different customer groups and develop targeted sales strategies. This information also helps in identifying potential cranial and facial implants market growth opportunities.

Cranial and Facial Implants Market by Region

The North America region has the largest cranial and facial implants market size in terms of revenue generation, with 38% market share. North America has a high demand for cosmetic procedures, including facial implants, as individuals seek to enhance their appearance and address age-related changes. Factors such as media influence, societal beauty standards, and a higher disposable income contribute to the growing demand for aesthetic procedures. This demand drives the cranial and facial implants market in the region. According to the Aesthetic Society, The average plastic surgeon performed 320 surgeries in 2021, compared with 220 in 2020. On average, the cost of a surgical procedure increased by 6% in 2021, and the cost of an anon-surgical procedure increased by 1%. North America is known for its advanced healthcare infrastructure and technological advancements. The region has seen significant developments in imaging techniques, computer-aided design (CAD), and 3D printing, improving the accuracy and customization of cranial and facial implants. These advancements have contributed to the growth of the market in North America. North America has relatively favorable reimbursement policies for cranial and facial implant procedures. Insurance coverage for these procedures, especially in cases of reconstructive surgeries, can alleviate financial burdens for patients and encourage the adoption of these implants.

Based on the regions, the global cranial and facial implants market is segmented into:

Regional demarcation of the industry will provide information on geographic pockets regarding the cranial and facial implants’ market outlook, size, share, and growth rate. This data helps businesses evaluate the expansion potential into new regional markets, understand the competitive threats across different regions, and develop localized sales and expansion strategies.

Key Components of the Report

Cranial and Facial Implants Market Competitive Landscape

The market competitive landscape is performed by collecting and analyzing information about the key competitors, the present industry trends, and market dynamics. It includes information collection and analysis on factors such as products, pricing, geographic outreach, customer demographics, marketing strategies, and recent developments. Competitive landscape assessment will help businesses identify current prevalent or potential opportunities and threats, considering the trends in cranial and facial implants industry.

Cranial and Facial Implants Market Strategic Developments

Key Strengths of Our Report

Target Audience to Benefit from this Report.

Reasons to Buy this Report

Cranial and facial implants are medical devices designed to enhance or reconstruct the structures of the skull and face. They are typically made from biocompatible materials and are surgically implanted to improve the appearance, function, or support of the cranial and facial features.

Asia Pacific can be considered as the key growth region due to the surge in cranial and facial implants devices industry trends in China, Japan, and the Indian subcontinent.

The cranial and facial implants devices market is expected to register a revenue CAGR of 6.7% during the forecast period from 2023 to 2031.

The demand for cranial and facial implants is expanding beyond traditional markets. Emerging economies like China, India, Brazil, and South Africa are experiencing rapid economic growth, rising disposable incomes, and increasing healthcare expenditure.

Market players often engage in strategic partnerships and collaborations to leverage each other's expertise and expand their product portfolio. This may involve collaborations with research institutions, healthcare providers, or other medical device companies.

The key players operating in the global cranial and facial implants market are Stryker Corporation, Depuy Synthes (Johnson & Johnson), Zimmer Biomet Holdings, Inc, KLS Martin Group, and Integra LifeSciences.

The porous polyethylene segment dominated the cranial and facial implants devices market.

The high treatment costs and risk of complications of cranial and facial implants are some of the restricting factors of the cranial and facial implants market.

The increasing demand for cosmetic and reconstructive surgeries and the rise in technological advancement are some of the major driving factors in the market.

*Insights on financial performance are subject to the availability of information in the public domain